Liquidity is a key component when it comes to analyzing a company’s financial health; it allows the company to meet its short-term obligations with the assets it has available. And, when it comes to running a successful business, liquidity and cash flow are the lifeblood of every business.

If you have read our other articles, such as How a 13-Week Cash Flow Forecast Model Can Benefit Your Business, you know that we are big believers in companies using cash forecasting as a management tool. In this article, we are going to discuss how companies can use the Cash Conversion Cycle (CCC) as an analysis tool to improve their cash flow and working capital utilization.

The Cash Conversion Cycle is often an underappreciated and overlooked financial tool that is significant in understanding a company’s operational efficiency and cash management. Despite its remarkable potential, the CCC approach has been underutilized by advisors and businesses alike.

In this article, we unpack the power and benefits of the CCC and shed light on why business owners, investors, creditors, and business advisors should embrace this invaluable tool.

What is the cash conversion cycle?

Traditional liquidity ratios provide a snapshot of a company’s short-term financial strength. The current ratio (current assets divided by current liabilities) and the quick ratio (cash & equivalents + marketable securities + accounts receivable divided by current liabilities) are the staples of these assessments. The ratios give a simplified perspective of a company’s ability to cover its immediate liabilities with readily available assets. However, these ratios lack the depth to capture the dynamics of cash flows and the time it takes for a company to convert its resources into cash.

The CCC, which was first introduced in 1980 by Verlyn Richards and Eugene Laughlin in their groundbreaking article “A Cash Conversion Cycle Approach to Liquidity Analysis,” is a model that is viewed as a dynamic approach that brings the element of time into the equation. It recognizes that the process of converting raw materials into finished goods, selling them, and ultimately receiving cash, involves several stages, each with its own unique time frame. The result is a more comprehensive assessment of a company’s liquidity position.

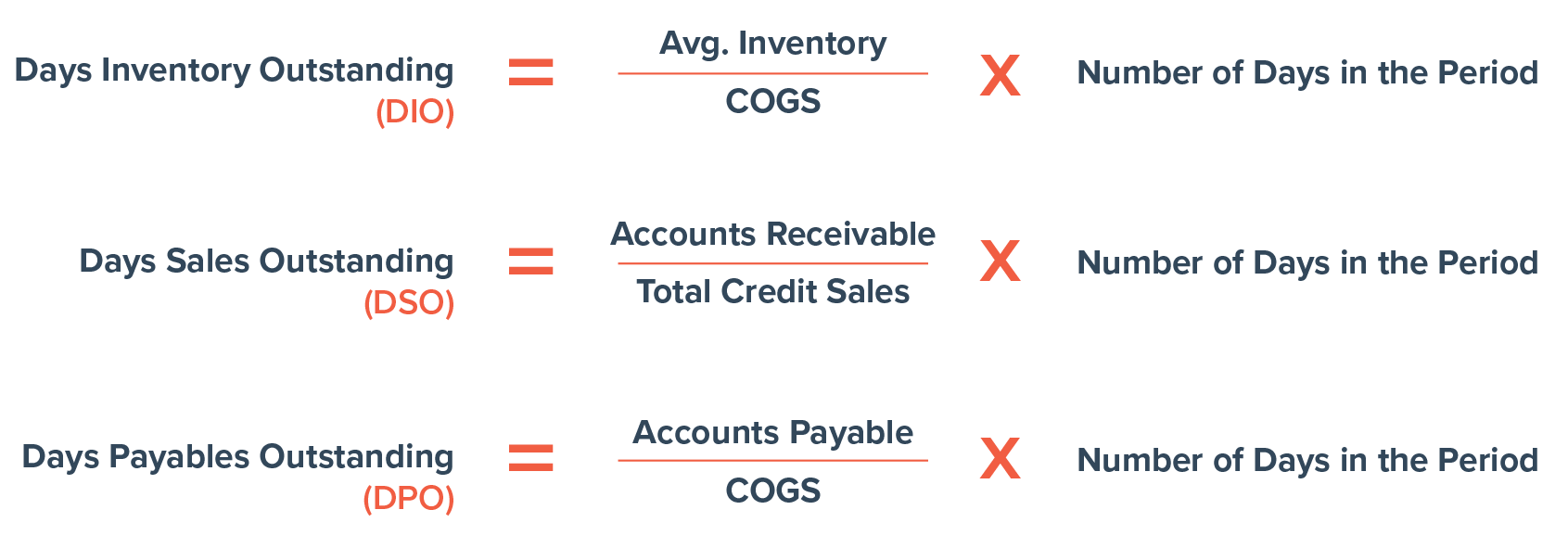

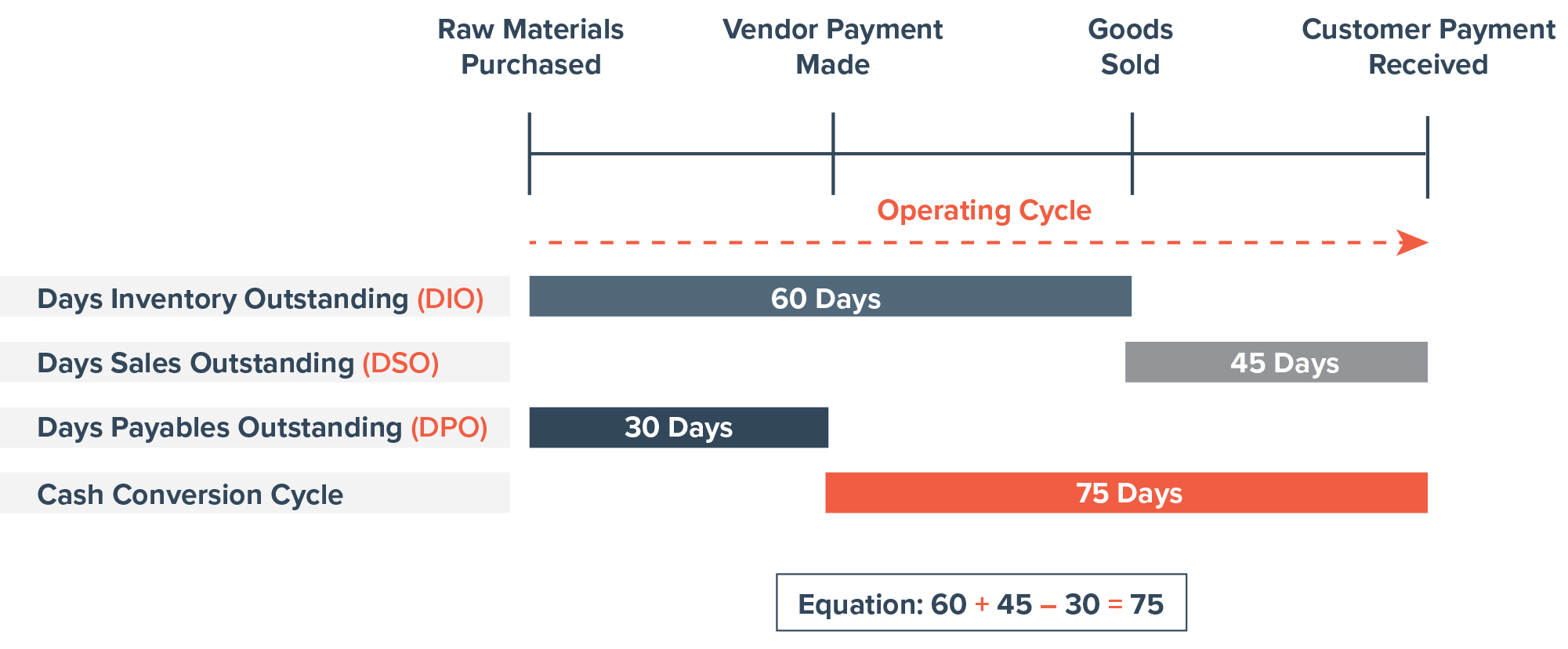

There are three key time-measuring components involved in the CCC to determine how long it takes for a company to convert its investment in inventory and other resources back into cash through sales:

- Days Inventory Outstanding (DIO)

This represents the average number of days it takes for a company to sell its inventory. A lower DIO implies more efficient inventory turnover and quicker conversion of inventory into sales. - Days Sales Outstanding (DSO)

DSO indicates the average time it takes for a company to collect payments from its customers after a sale. A shorter DSO signifies better credit and collection policies, leading to faster cash inflows. - Days Payables Outstanding (DPO)

DPO measures the average time a company takes to pay its suppliers. Extending payment terms can provide a source of short-term financing, resulting in longer cash outflows.

To calculate the CCC you need to subtract DPO from the sum of DIO and DSO: CCC=DIO+DSO−DPO

So, while traditional liquidity ratios provide valuable insights into a company’s immediate financial standing, the fact that they don’t account for the element of time in the liquidity equation creates a gap that the CCC fills. By considering the cycle alongside traditional ratios, business leaders and analysts can gain a more thorough understanding of a company’s operational efficiency, cash flow management, and potential liquidity risks.

Benefits of the CCC

It is a dynamic measure that paints a vivid picture of how efficiently a company’s working capital operates. It’s like a heart monitor for a company’s financial health – it measures a company’s net investment in working capital. It considers the time it takes to convert resources into cash and offers several benefits.

- Operational Efficiency

A shorter CCC signifies streamlined operations, efficient inventory management, and swift conversion of resources into cash. - Cash Flow Management

By identifying areas where cash is tied up in the operating cycle, a company can devise strategies to optimize cash flow and reduce the cycle time. - Risk Assessment

CCC analysis highlights potential liquidity risks that may arise due to delays in inventory turnover, slow collections, or unfavorable payment terms. - Comparative Insights

CCC allows for meaningful comparisons between companies in similar industries, enabling business leaders, investors, creditors, and analysts to assess how different operational strategies impact liquidity. - Informed Decision-Making

Business leaders and investors can make more educated business decisions by considering a company’s operational efficiency and liquidity position through the CCC lens. - Business Advisors

Business advisors, specifically Financial Advisors, armed with CCC insights can offer strategic guidance to enhance working capital management for their clients.

The CCC can be an impactful metric for gauging overall changes in working capital and liquidity, allowing companies to invest excess cash flows back into revenue (profit) generating activities. Why should you strive to familiarize yourself with the CCC? The answer is simple: because the CCC is not just a tool; it’s a perspective shift. For business leaders, the CCC provides a more educated perspective on how cash is moving through their business, or in some cases where the cash is getting “stuck”.

The CCC stands as an underutilized treasure trove of financial insights. Its dynamic approach, time-sensitive analysis, and operational focus make it a vital tool for anyone seeking a holistic understanding of a company’s financial dynamics. Business leaders must break free from the confines of traditional liquidity measures and embrace the potential of the CCC. By doing so, they’ll equip themselves with a powerful instrument to decipher the intricate workings of companies and industries, paving the way for more informed decisions and prosperous financial landscapes.

The experienced team at JACO Advisory Group can help you calculate and understand your CCC, benchmark against industry peers, and help you identify trends that can help you make strategic, informed decisions. Give us a call, or drop us an email so we can learn more about your business and what you are looking to achieve.

If you found this topic interesting, our strategic partner DWH published content you may find relevant as well: Understanding Your Cash Conversion Cycle.

About Jeff

Jeff has over 30 years of strategic planning, business development, and business transformation leadership experience. Having worked with mid-market, closely-held and family-owned businesses his entire career Jeff has a unique understanding of how these enterprises operate and the challenges they face.

He is passionate about working with business leaders to build strong cultures while developing and executing strategies that deliver exceptional results that benefit all the company’s stakeholders. Jeff’s hands-on approach to working with companies begins with a commonsense approach to strategy development.

With extensive experience in organizational turnaround and growth Jeff follows a defined process (disciplined, focused, intentional) to guide clients from strategy to execution. His experience covers a multitude of industries, with an in-depth understanding of automotive manufacturing.

Jeff holds a Master’s in Business Administration from the Capital University School of Management and earned a Bachelor of Arts in Business Administration and Management from Ohio Dominican University.