Good cash flow management is essential to the success of any business. Unfortunately, many businesses wait until they have a poor earnings report or face financial distress to implement a 13-week cash flow forecast.

Knowing how much money will be coming in and going out of your company each week can help you make important decisions about spending, investments, and other financial matters.

Below, we’ll discuss why having an accurate 13-week cash flow forecast can benefit your company as well as provide you with tips on how to implement one for your business. We’ll also look at how data from these forecasts can be used to make better decisions about future spending, debt financing, and how to utilize excess cash.

The benefits of cash flow forecasting.

A key aspect of managing your business’s financial performance is forecasting cash flow accurately. This can be a daunting task, but with the right tools and process in place, it can help you better anticipate cash inflows and cash outflows while allowing you to make informed decisions regarding your company’s liquidity.

Moreover, this forecasting method provides you with greater visibility into your business operations’ liquidity needs, helping you to ensure timely vendor payments, payroll coverage, and debt service payments, while protecting your cash reserves.

Why it is important to have an accurate cash flow forecast.

As a business owner or financial decision maker, having an accurate cash flow forecast is a key component for working capital management. It allows you to predict short-term liquidity needs, plan for investments, and keep your company on track financially.

Cash is king.

Without an accurate forecast and forecasting process, you could become overextended, without enough cash to pay creditors, or risk missing critical investment opportunities.

This is why it’s essential to take the time to create a process and accurate cash flow model that’s based on your company’s historical data, current economic conditions, and future projections. Not only will it help you stay afloat during periods of stress and distress, but it can also help you capture market opportunities more efficiently, invest funds strategically, and ultimately achieve improved financial performance.

4 steps for creating a 13-week cash flow forecast.

Creating a 13-week cash flow forecast can be a daunting task, especially if you’re not accustomed to cash flow forecasting. However, with a little guidance from a seasoned financial advisor, anyone can create a solid weekly forecast.

Step 1

Gather all necessary financial data, including bank accounts (beginning cash balance), checkbook history, accounts payable and accounts receivable.

Step 2

Next, make a list of expected cash inflows and outflows over the next 13 weeks – if 13 weeks is too daunting, start with a 1-week cash flow window and expand it weekly until you get to a full 13-week forecast that you are confident in.

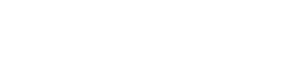

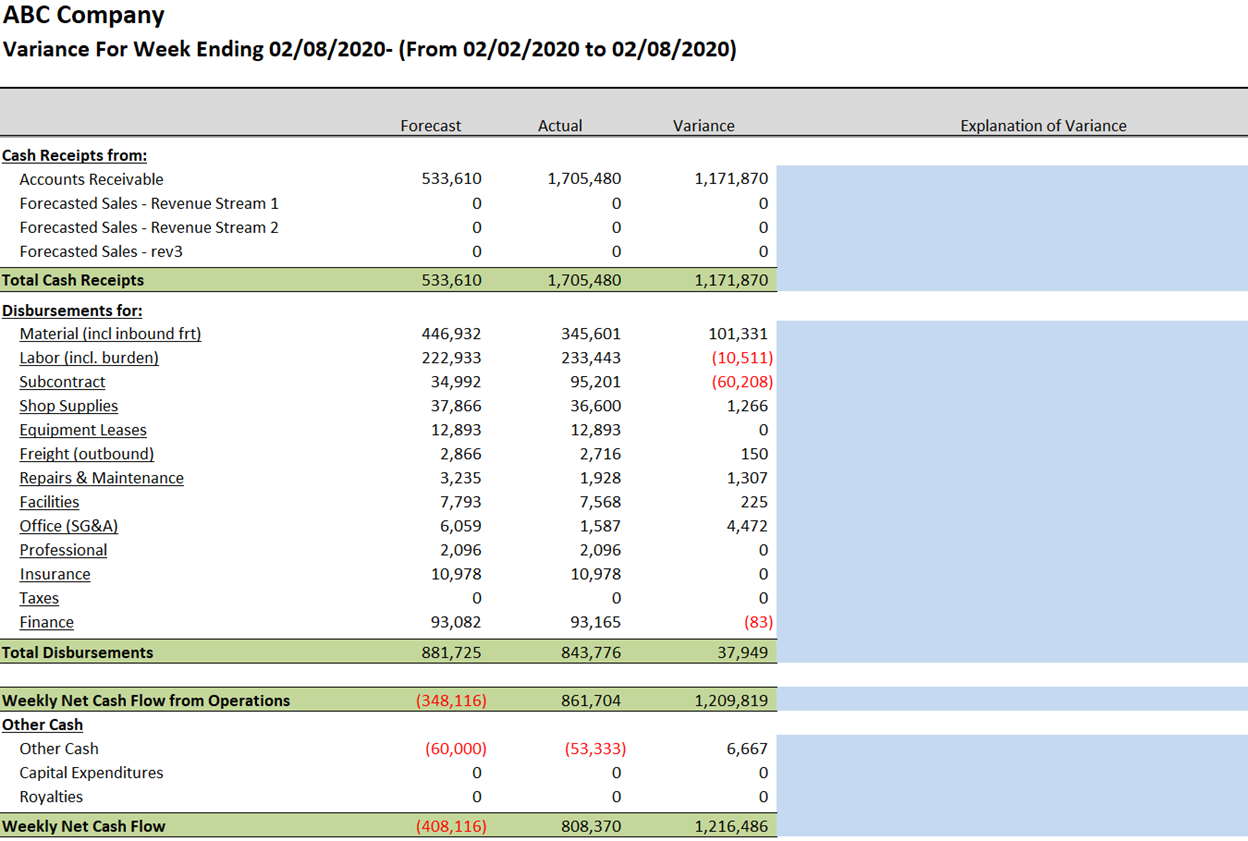

Weekly Cash Flow Forecast Example

Step 3

Identify any patterns or trends in your cash flow, perform a variance analysis of weekly cash receipts and cash outflows that may impact your 13-week cash forecast.

Step 4

Select a cash flow model that allows you to incorporate all of the financial data into a 13-week cash flow forecast. For example, your ERP system, or other financial software utilized by your company might allow you to create a cash flow forecast that takes into account all of these factors.

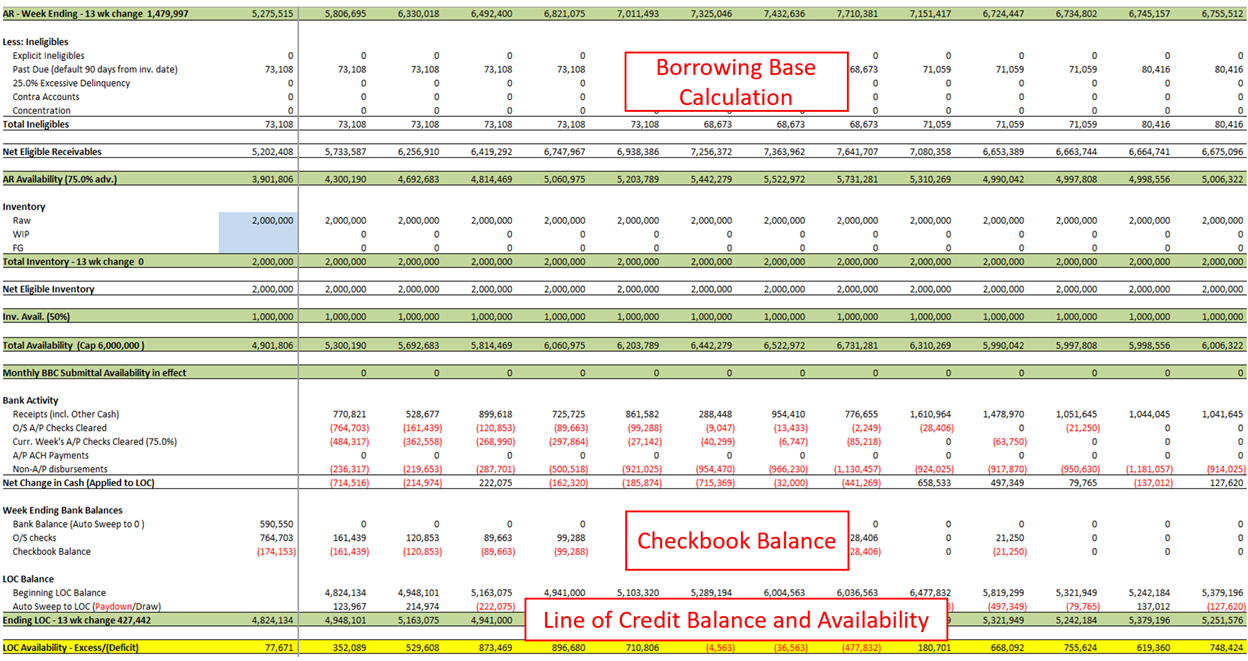

Many of our clients utilize our Excel-based 13-week cash flow model. This proprietary model has all of the complex formulas pre-coded so that it monitors debt covenants, and other reporting requirements banks generally require.

After initial set-up, the vast majority of our clients can roll their 13-week cash flow in about 1 hour each week. This allows them more time to spend analyzing their data so they can make better and more informed decisions regarding their cash management practices.

How to use data from your forecasts to make better decisions about future spending & investments.

With the abundance of data available to us today, making smart financial decisions can seem overwhelming. However, if you take a closer look at your weekly forecast and use the data effectively, you can gain invaluable insights that can help you make informed decisions about your planned cash receipts and disbursements.

Weekly Variance Analysis Example

One tip is to pay close attention to trends in your data – are there any patterns or cycles you can identify? We encourage companies that we are working with to run different scenarios to test their financial model and evaluate the impact they would have on the company’s working capital.

Weekly Cash Monitoring Example

Finally, make sure to regularly re-evaluate your forecasts. Some companies do this monthly, but we suggest that it be updated weekly, or in cases of financial distress on a daily basis. By staying vigilant and using your data effectively, you can make confident decisions for your business’ financial future.

Cash forecasting can help you manage your business finances more effectively.

Forecasting your business finances can help you make informed decisions that will drive your business towards success. With accurate forecasting, you can estimate your expected revenue, expenses, and profits for the upcoming period, allowing you to make adjustments to improve the overall health of your business.

Whether you’re anticipating an increase in sales or expenses, forecasting how much cash you will have on hand on any given day empowers you to be proactive in managing your finances by identifying potential areas of concern before they arise.

Additionally, forecasting can help you track your progress and keep tabs on your financial health, ensuring you stay on the right track towards achieving your goals. With forecasting as a tool in your company’s toolkit, you will be better equipped to:

- Manage your cash balances

- Improve your financial reporting to your bank or other stakeholders

- Navigate potential challenges along the way

By taking the time to create an accurate and up-to-date 13-week cash flow forecast, you can improve how you manage cash to ensure your business is well-positioned to take advantage of future opportunities. A solid 13-week cash flow model provides more than just a cash flow forecast, it is a data source that companies use to monitor debt covenants – including their debt service coverage ratio, their cash conversion cycle, and report short term and medium-term financing needs to their banks.

All too often, liquidity constrained companies lack adequate cash management processes and tools.

With a comprehensive and reliable forecast in place, you’ll have a better understanding of your expected cash flows and be able to make informed decisions about spending and investments. Ultimately, this will enable you to take control of your finances, stay one step ahead of financial challenges, and grow your business for years to come.

Need help implementing a cash flow forecast?

If you would like to talk and learn how we help companies implement and utilize a 13-week cash flow forecast to make better cash management decisions, give us a call, or drop us an email, we would welcome the opportunity to learn more about your business.

If you found this topic interesting, our strategic partner DWH published this content that you may find relevant as well: Managing Cash Flow During Business Disruptions.

About Jeff

Jeff has over 30 years of strategic planning, business development, and business transformation leadership experience. Having worked with mid-market, closely-held and family-owned businesses his entire career Jeff has a unique understanding of how these enterprises operate and the challenges they face.

He is passionate about working with business leaders to build strong cultures while developing and executing strategies that deliver exceptional results that benefit all the company’s stakeholders. Jeff’s hands-on approach to working with companies begins with a commonsense approach to strategy development.

With extensive experience in organizational turnaround and growth Jeff follows a defined process (disciplined, focused, intentional) to guide clients from strategy to execution. His experience covers a multitude of industries, with an in-depth understanding of automotive manufacturing.

Jeff holds a Master’s in Business Administration from the Capital University School of Management and earned a Bachelor of Arts in Business Administration and Management from Ohio Dominican University.