Not all business owners are finance experts; however, nearly every entrepreneur understands that managing cash flow and building and preserving liquidity are necessities for success. By developing and utilizing a forecasting tool to improve daily decision making, while effectively communicating with internal and external stakeholders, the savvy owner can achieve this forward-looking financial feat.

During my years in the turnaround industry, I have come to rely on a 13-week cash flow forecast as my go-to document which focuses on looking forward and solving liquidity problems before they occur. A 13-week rolling cash flow forecast shows the details of anticipated cash receipts, cash disbursements, and changes in bank collateral through the forecast period. Across industries and turnaround scenarios, a simple 13-week cash flow model is a fundamental tool for business leaders to monitor the pulse of their organizations. In the following text, I will explain how to implement and utilize this relatively easy to interpret, yet highly effective forecasting tool.

Bridging the GAAP

Managing cash is not always easy — especially in the face of economic uncertainty, industry disruption, and changing customer habits. In these economically uncertain times – the better a company understands how its cash moves, the better positioned it will be to improve capital allocation, and to take advantage of opportunities available for limited periods of time. While periods of stress can prompt a company to monitor its cash more closely, a company’s cash flow is something that should be monitored in the good times and bad.

Create Transparency and Accountability with the 13-Week Cash Flow Forecast

When I work with a company to improve their operations’ overall health, a 13-week rolling cash flow model tells us how quickly we need to move, what our priorities need to be, and ultimately becomes the leading indicator of how well we are executing our plan.

Whether you are an organization going through a period of stress or distress, if you are not generating positive cash flows, you are on the clock for how long you can survive. Using a 13-week cash flow model should be your tool for day-to-day cash management as well as significant spending decisions and operational planning.

Deciding where you can spend money, who gets paid and when, and how to deal with unplanned events are all questions answered with a 13-week cash flow model. It is also your planning tool to ensure you maintain compliance with your bank or can serve as a road map for getting back into compliance.

Further, it becomes the tool that you use for your commercial discussions with your customers. The 13-week cash flow model cuts through the noise and pinpoints the timeframe you need to be paid, and when fully implemented, will quickly point out if you have pricing issues, payment term mismatches or other commercial issues that need to be addressed.

Navigating the 13-Week Cash Flow Forecast

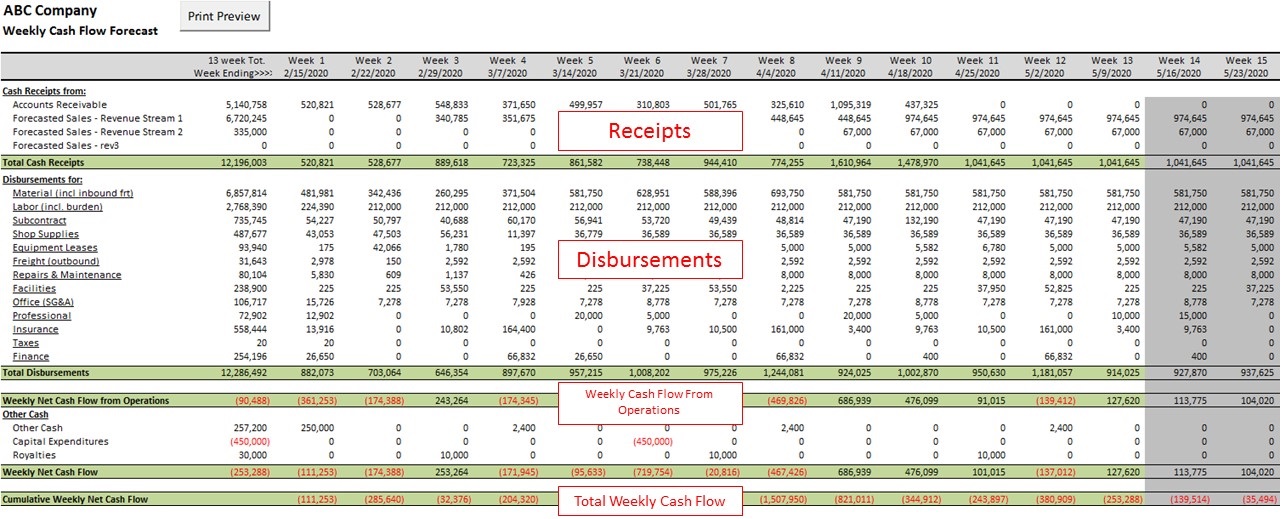

Below are some examples from the 13-week cash flow forecast that I like to use. As you can see, each receipt and disbursement category are listed. This model is supported by direct file uploads, as well as manual inputs, or assumptions that translate business activity to cash inflows or outflows.

The model continues to drill down further to identify other cash and capital expenditures, ultimately generating a weekly net cash flow and at the very bottom a cumulative weekly cash flow.

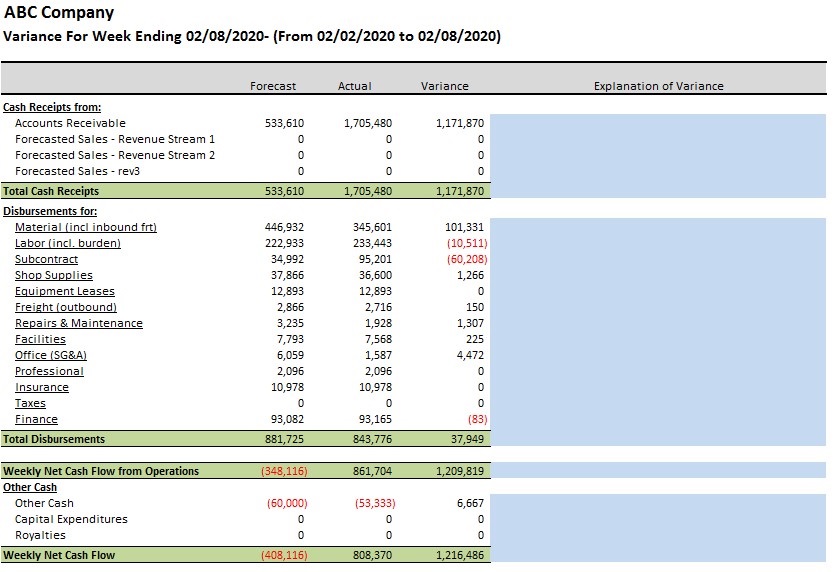

You then couple this with a weekly review of the variances between your plan and the actual cash receipts and disbursements. This allows you to better manage the activities of the business and make adjustments to improve your model and its accuracy.

Simple, isn’t it? If we stop here, management will have a clear and immediate understanding of their company’s cash flow for the next 13 weeks, right?

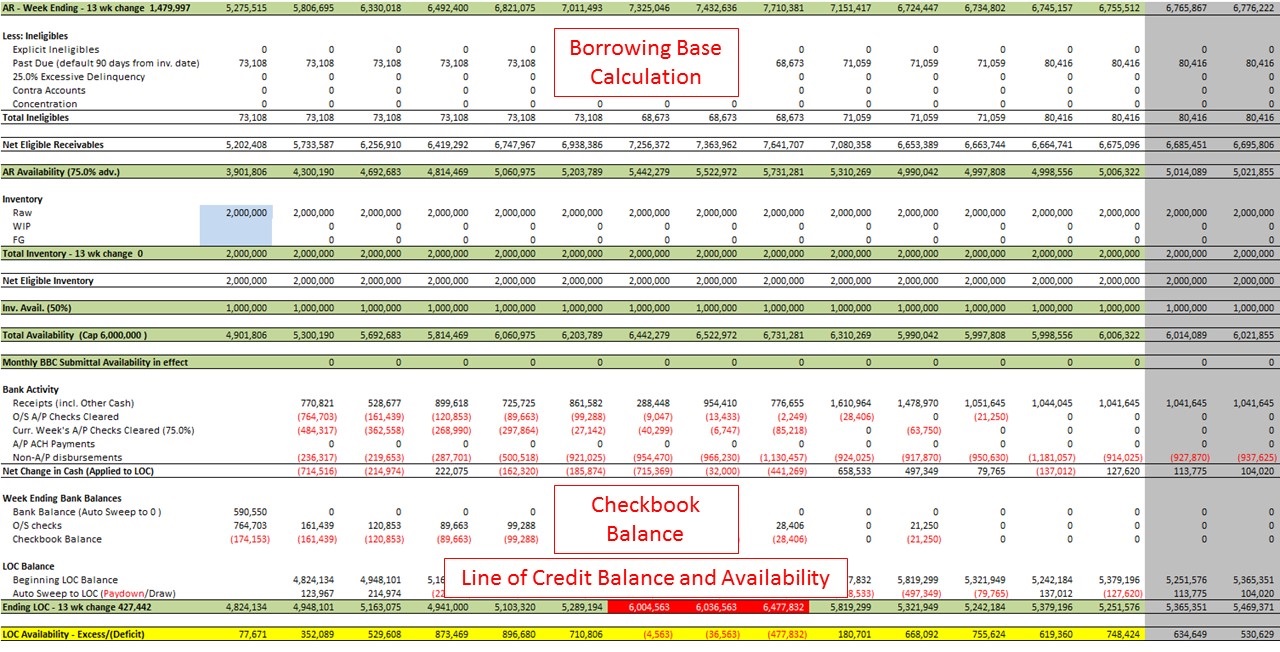

There is more to the story. The model then executes the company’s line of credit (LOC) calculations. This is very helpful for the non-financial manager because it calculates the amount of credit available to run the company from the bank’s point of view.

The document quickly indicates the planned weekly cash flows and their impact on the LOC, generating a new expected line availability. Should the report indicate that there is a potential out of compliance situation developing, the management team has time to react and either take alternative measures or develop plans with its lender. The point is to see thirteen weeks into the future and manage your borrowing capacity.

Communicating the Findings

Arguably one of the more important elements of a 13-week cash flow forecast is communication. Sharing the findings with internal and external stakeholders will allow them to understand how their investments are being protected. This document then becomes a framework for improving liquidity and supporting timely and effective decision-making.

As you can see, a finance or accounting person could spend hours upon hours with a 13-week cash flow forecast, but they do not need to. If you select the right cash flow model, like the one I use, you can roll your company’s 13-week cash flow in about 1 hour per week.

When was the last time you looked at your company’s 13-week cash flow forecast?

If you would like to talk and learn how we help companies implement and utilize a 13-week cash flow forecast to make better cash management decisions, give us a call, or drop us an email, we would welcome the opportunity to learn more about your business.

If you found this topic interesting, our strategic partner DWH published this content that you may find relevant as well: Managing Cash Flow During Business Disruptions.

About Rob

Rob has over 35 years of automotive experience, 25 with Honda of America Manufacturing. His specialty is helping manufacturing facilities turn their operations around.

He has supported companies through bank workouts, cash burn analysis, and developing plans of reorganization to exit bankruptcy. His experience with operations of all types of production facilities gives him a comprehensive proficiency when it comes to addressing unprofitable practices and cultures.

Rob is certified by the Turnaround Management Association as a Certified Turnaround Professional (CTP).

During several new model launches, Rob managed the Marysville Auto Plant’s mass production purchasing department. He was responsible for the supply chain and synchronization of over 4 million parts daily.

Before Honda, Rob was the regional quality auditor for MascoTech Stamping Technologies, responsible for plants in Indiana, Michigan, and Ohio. He was often recruited by Nissan to evaluate potential new suppliers.

Rob holds a Bachelor of Science in Business Administration from Ferris State University. He is a senior member of the Society of Manufacturing Engineers and was a Certified Quality Auditor through the American Society of Quality.