The relationship between banks and their clients has long been the foundation of the global financial system. However, in recent years, a discernible shift has occurred, with banks becoming increasingly selective about the clients they choose to lend to. In their pursuit of a balanced and diversified loan portfolio, banks actively manage concentration risk. This means limiting their exposure to particular sectors, regions, or large clients to reduce the potential impact of adverse events in those areas. Banks are inherently risk-averse entities, aiming to preserve their capital and maintain stable profitability. As a result, they are now more cautious about lending to clients perceived as higher risk, especially those operating in volatile or cyclical industries or facing financial difficulties.

These practices have left some businesses and individuals looking for sources of funding outside traditional banks. Companies experiencing financial difficulties or going through a turnaround phase may be perceived as high-risk borrowers by traditional banks; however, private credit lenders may see potential in these businesses and be willing to provide the necessary capital for growth or rehabilitation. For distressed companies, private credit can offer a lifeline, helping them regain stability and profitability.

This article defines private credit, its rapid growth, and the benefits and risks to small and medium-sized businesses. We will explore why the private credit market has become a lifeline for such businesses, providing them with the support and resources needed to thrive. It is important to note that in this article we are not choosing sides, but rather attempting to educate others on this financing option that may be available to them.

What is Private Credit?

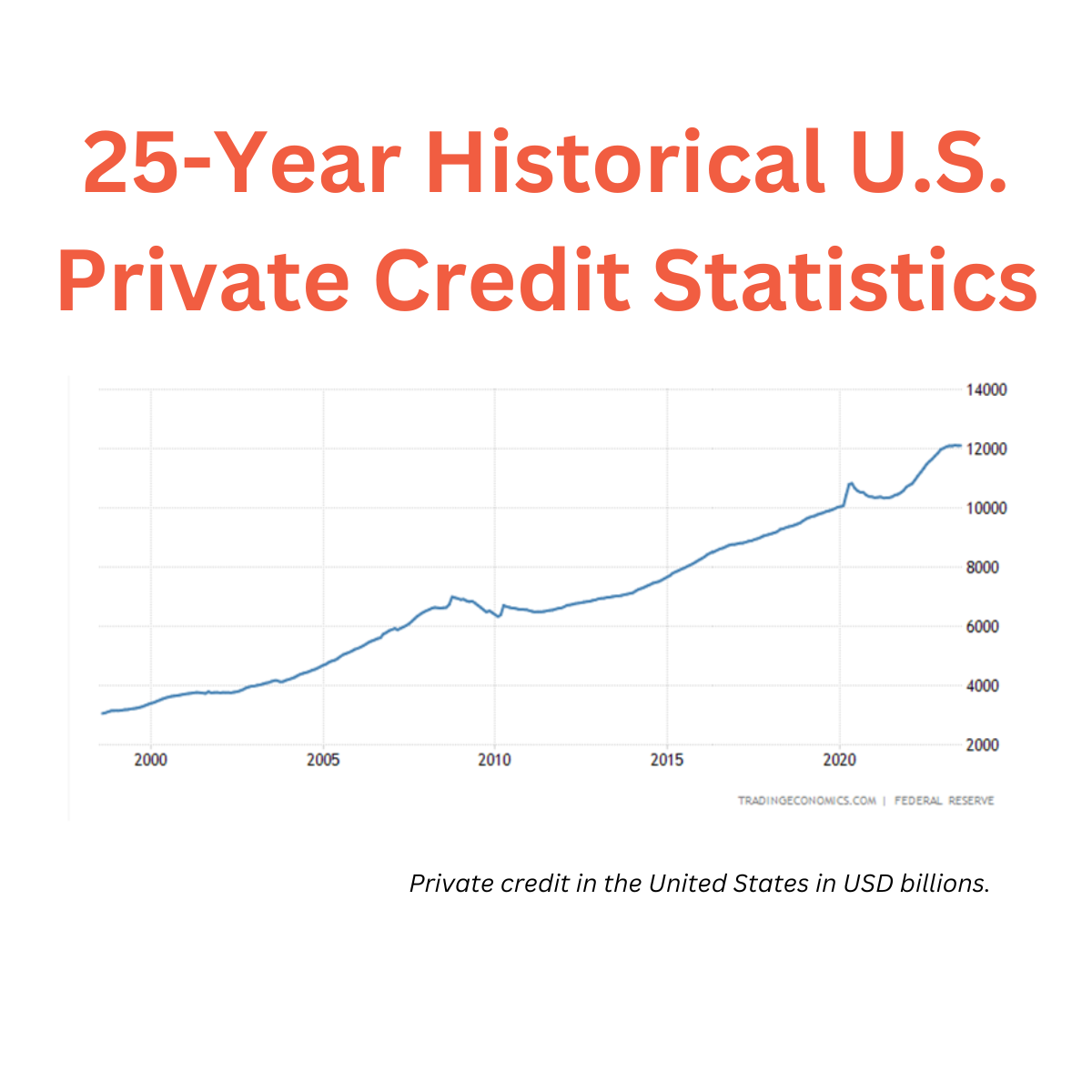

Private credit is non-traditional lending. It’s one of the fastest-growing segments in the lending landscape which got a boost when the 2010 Dodd-Frank Act—Congress’s response to the global financial crisis—pushed a lot of risky lending outside the traditional banking sector. The amount of private credit debt has grown rapidly to about $1.5 trillion globally as of September 2022, from just over $300 billion at the end of 2010, according to financial data provider Preqin Ltd. The US junk-bond and leveraged-loan markets are each about the same size. While fundraising has slowed recently, the momentum isn’t expected to stop as Preqin projects private credit will hit $2.2 trillion by 2027.

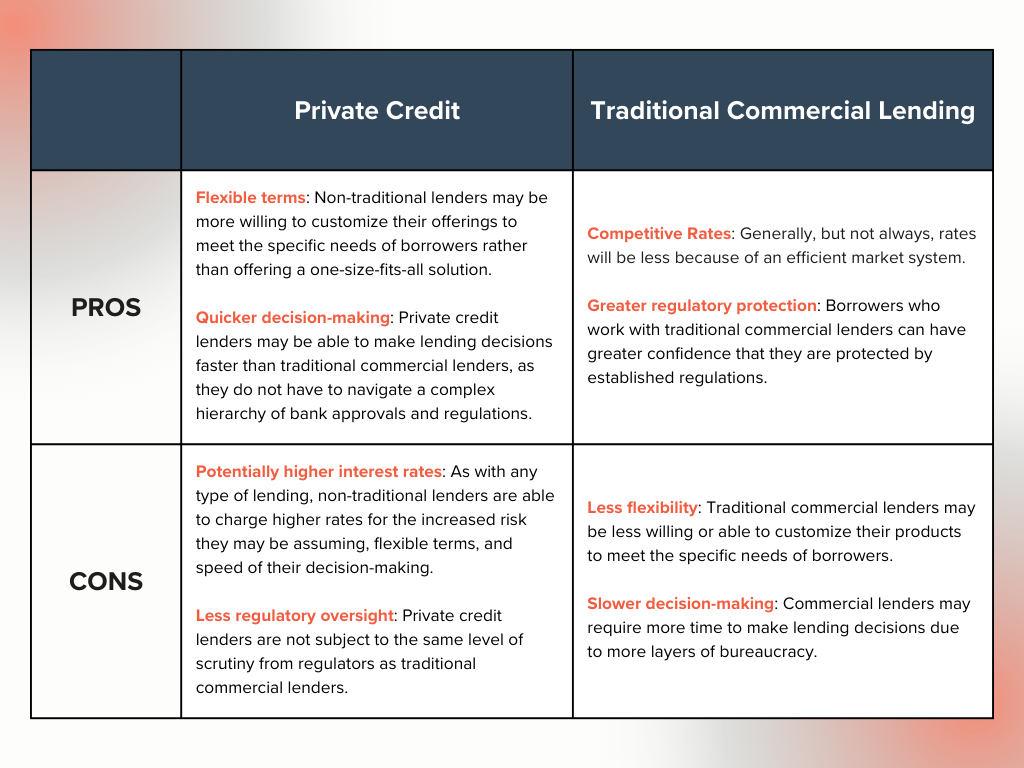

Non-traditional lenders provide an alternative to traditional bank lending and are becoming increasingly popular due to their agility, technological innovation, and willingness to furnish credit in an otherwise restrictive regulatory environment. Unlike banks that adhere to strict lending criteria, private credit lenders have the flexibility to evaluate companies based on their unique financial circumstances and potential for growth. They often take a more holistic approach to underwriting, considering factors beyond just credit scores and collateral. This allows them to extend credit to companies with compelling business models, despite facing temporary financial challenges or having limited physical assets to offer as collateral.

Tailored Solutions and Flexibility

Unlike often un-customizable conventional loans, private credit instruments can be tailored to meet the unique needs of borrowers. This flexibility enables borrowers to obtain financing solutions that may not be available through traditional lenders, particularly in niche industries or unconventional projects.

Here is a snapshot of the pros and cons of each:

Streamlined Decision-Making

Bank loan approval processes can be lengthy and cumbersome, causing delays for companies needing swift access to capital. In contrast, the private credit market operates with a sense of agility and efficiency. The streamlined decision-making and faster funding cycles enable companies to seize opportunities, finance time-sensitive projects, or address immediate cash flow needs promptly.

Lack of Collateral or Creditworthiness

Traditional bank lending typically relies on a client’s collateral and creditworthiness as key determinants of loan approval. If a client lacks sufficient assets to offer as collateral or has a subpar credit history, banks may be hesitant to extend credit due to the increased risk of default.

Companies operating in niche industries or pursuing specialized projects might find it challenging to secure bank loans due to the perceived higher risks or unfamiliarity. The private credit market, however, may be more receptive to these ventures, as its investors often have different risk profiles and a deeper understanding of such industries and projects. By taking the time to assess the underlying fundamentals and growth prospects, private credit lenders can unlock financing opportunities that don’t fit in a traditional bank’s portfolio.

Shifting Industry Dynamics

Changes in the economic landscape and industry dynamics can significantly impact banks’ lending preferences. For example, technological advancements, regulatory changes, or shifts in consumer behavior may make certain industries less favorable for banks, leading to reduced lending in those sectors.

Private credit lenders excel in crafting tailored financing solutions that cater to the specific needs of businesses. Whether it’s structuring flexible repayment terms, less restrictive covenants, or offering revenue-based financing, the private credit market can accommodate the diverse requirements of companies that do not fit into the standardized bank lending framework.

Knowing and Weighing Your Options

In a financial landscape dominated by traditional banking, the private credit market stands out as a beacon of hope for companies that might otherwise struggle to obtain financing. Its allure lies in the flexibility of underwriting, willingness to explore niche industries, swiftness in processing applications, and the ability to craft customized financing solutions. By catering to the unique needs of businesses and focusing on long-term potential rather than immediate risk, the private credit market empowers companies to flourish and reach their full potential, contributing to a more diverse and resilient economy.

As the financial world continues to evolve, it’s crucial for businesses and individuals seeking financing to understand the shifting dynamics of the banking industry. While traditional bank lending may not be the only option available, remember, regardless of what type of lender you choose, you still must have a viable business plan that achieves a successful outcome for the various stakeholders of the business, which includes your lender. Both traditional and non-traditional lenders will be evaluating you and your plan as a means of assessing risk. They will want to see a documented and well-thought-out business plan, a team of qualified individuals capable of executing the plan, tight financial controls, sound cash management practices, and management practices that de-risk the business’s operations. Your ability to do this well will improve your ability to secure funding from any source.

If you’re not sure which option is best for you and your company, the experienced team at JACO can help you navigate that decision. Give us a call, or drop us an email, we would welcome the opportunity to learn more about your business and what you are looking to achieve.

About Jeff

Jeff has over 30 years of strategic planning, business development, and business transformation leadership experience. Having worked with mid-market, closely-held and family-owned businesses his entire career Jeff has a unique understanding of how these enterprises operate and the challenges they face.

He is passionate about working with business leaders to build strong cultures while developing and executing strategies that deliver exceptional results that benefit all the company’s stakeholders. Jeff’s hands-on approach to working with companies begins with a commonsense approach to strategy development.

With extensive experience in organizational turnaround and growth Jeff follows a defined process (disciplined, focused, intentional) to guide clients from strategy to execution. His experience covers a multitude of industries, with an in-depth understanding of automotive manufacturing.

Jeff holds a Master’s in Business Administration from the Capital University School of Management and earned a Bachelor of Arts in Business Administration and Management from Ohio Dominican University.