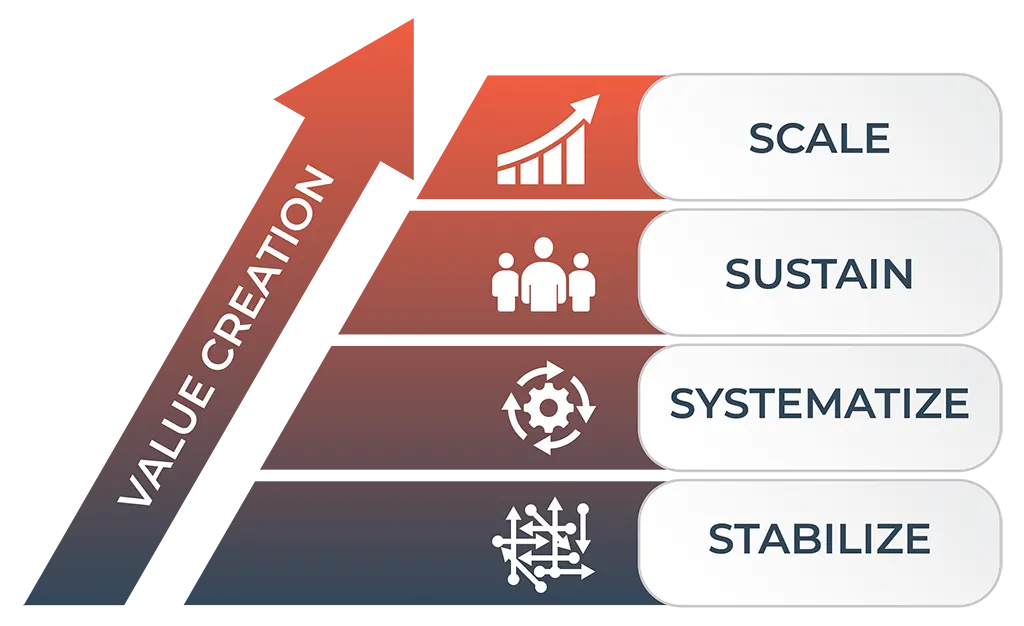

At JACO, we are builders—steady, resourceful, and motivated to help shape what comes next. Our leadership goes beyond the numbers, beyond accounting, beyond financial statements and metrics. By connecting finance to the broader business, we ensure that growth is strategic, sustainable, and grounded in operational excellence. This means rolling up our sleeves to understand foundational processes, drive performance, and help elevate every part of the business.

Interim CFO & COO Services

When you’re facing critical transitions—unexpected turnover, rapid growth, or preparation for a sale—our experienced financial leaders step in to provide immediate expertise and steady leadership. We bridge the gap during key employee transitions, ensuring business continuity while systematically building the internal capabilities your team needs for long-term success.

Working Capital & Cash Flow Management

Many profitable companies run into cash flow problems simply because they lack visibility into the timing of cash in versus cash out. We implement practical cash management tools, including 13-week cash flow forecasting, that transform financial data into actionable management information. These tools help business owners make informed decisions about investments, inventory, hiring, and growth initiatives with confidence.

Financial Modeling & Product Costing Analysis

From pricing strategy optimization to profitability analysis, we help you understand which customers, products, and business lines truly drive value. Many middle-market businesses struggle with accurate product costing—they know their overall margins but can’t confidently say which specific products, customers, or orders are profitable.

Our financial modeling and cost analysis provide the clarity needed to support critical business decisions on capital investments, capacity allocation, and customer pricing. We establish the proper cost standards and allocation methodologies that ensure your costing remains accurate as your business evolves, identifying opportunities and mitigating risk that might otherwise be hidden in complex datasets.

Due Diligence

Whether you’re considering an acquisition, preparing for a sale, or conducting an internal assessment, our due diligence services provide objective analysis of financial health, operational performance, and growth potential. Our product costing analysis reveals true profitability by customer, product line, and order—critical insights that inform valuation, identify synergies, and uncover risks that traditional financial reviews often miss. We bring the perspective of operators—not just accountants—who understand how the numbers connect to real-world business performance.

Financial Advisory Restructuring Services

For businesses facing financial pressure, we provide the expertise needed to stabilize operations, negotiate with stakeholders, and develop credible turnaround plans. Our financial advisors work alongside you to restore visibility, rebuild lender confidence, and implement the cash flow management and financial controls needed to navigate challenging situations.

Acquisitions, Integrations & Divestitures

Transactions require more than just financial acumen—they require skillful communication with multiple stakeholders and deep operational knowledge. We support companies through complex transactions, from initial due diligence through post-merger integration or divestiture completion.