OVERVIEW

- Revenue: $50,000,000

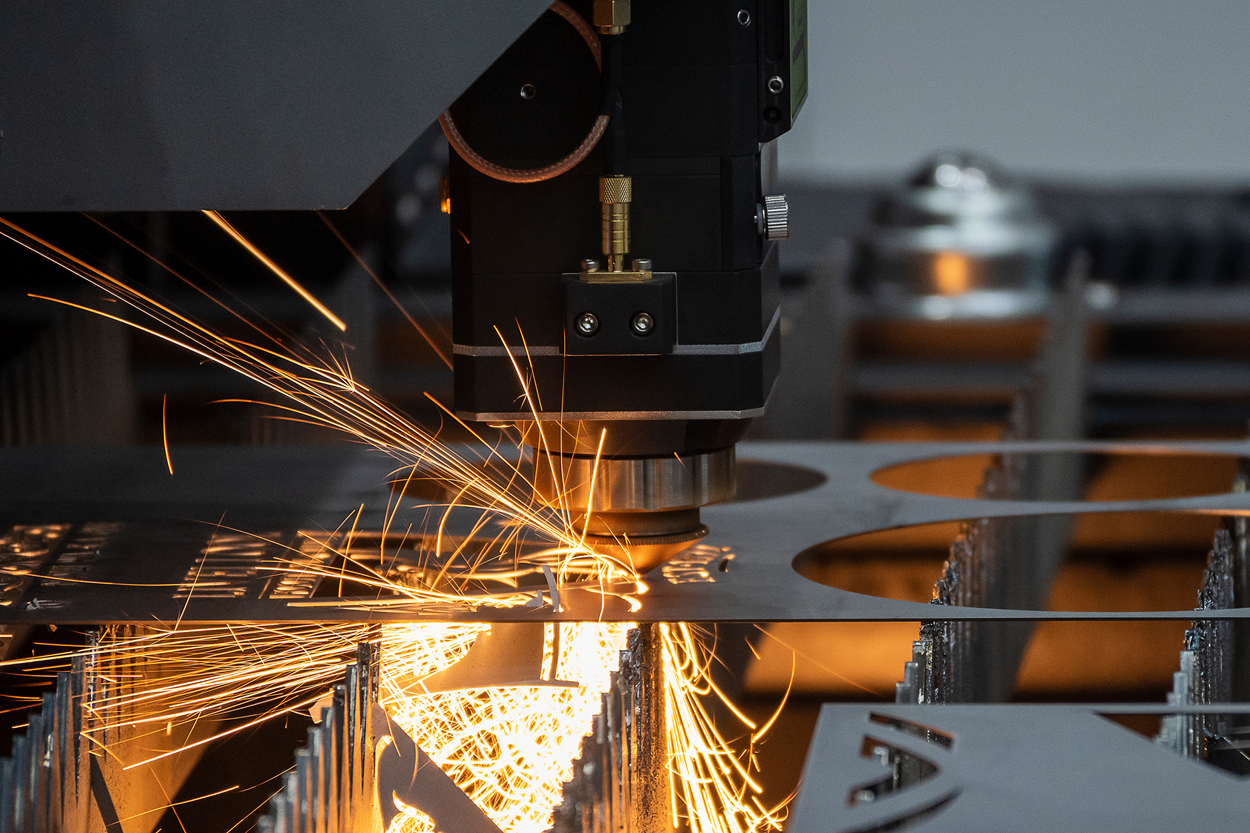

- General Description: Manufacturing

- Geographic Location: United States

- Markets Served: Office Furniture and Storage

THE SITUATION

A financially healthy, 55-year-old U.S. manufacturer has primarily served the office furniture segment with metal filing, storage, and organizational products for personal and commercial use. Like many manufacturing companies, COVID dramatically changed their world, as the work-from-home trend combined with digitization shifted demand for storage products. As Metalworks’ primary market went through change, leadership acted in 2 ways:

- Metalworks began diversifying its customer base by expanding into K-12, construction, and medical markets. These efforts generated revenue and provided insights into the new segments.

- Metalworks strategically invested in the acquisition of Flairwood, a laminate furniture company, to offer customers broader solutions.

As Metalworks learned from its diversification and the two companies came together, it became time to prioritize all the growth opportunities.

THE SOLUTION

JACO Advisory Group (JACO) first partnered with the company leadership to complete deep-dive segment assessments of the various opportunities. “Metalworks’ segmentation was essential to prioritize our growth efforts. Quantifying the segment sizes and growth rates, combined with a deeper understanding of the competition, trends, and customer needs, helped us determine where to add horsepower. Metalworks has a history of investing heavily behind growth, but without understanding these opportunities, it is not wise to spend aggressively. We now appreciate each segment’s size and opportunity. This informed our planning and drove prioritization,” said Tom Paine, Metalworks CEO.

Step two was a multi-day workshop with executive leadership to prioritize and flesh out its company-wide and market-segment-specific growth initiatives. “JACO challenged our team to look objectively at a wide breadth of alternatives and helped our company focus on a select few growth levers. We left the workshop aligned on what we will do and, maybe more importantly, where we will not focus resources. JACO brought tools that first challenged our team to diverge in its thinking, and then followed by facilitating the prioritization session in a unique manner. When you have company ownership combined with line leadership in the room, things can sometimes get uncomfortable. The Six Thinking Hats technique, combined with our industry analysis, empowered everyone to provide fact-based arguments. This combination enriched our plan and got us to new places,” shared Scott Lakari, Metalworks President.

THE OUTCOME

Metalworks’ culture has historically been very strong at executing, whether operationally, commercially, or across its shared services. So, the 2024 strategic planning efforts were tailored to link the initiatives into Metalworks’ existing execution framework. The team has significant implementation work ahead, but the pathway and priorities are now extremely clear. The company whittled all growth ideas down to two company-wide plus two business-specific initiatives:

- Both company-wide initiatives enable customers to have better access to Metalworks’ and Flairwood’s combined product offering, linking the company’s sales, customer service, quoting and engineering with customer needs.

- The business-specific initiatives enable Metalworks to diversify into adjacent market segments over the upcoming years, which will help improve asset utilization and drive growth from the operational core.

Metalworks defined one project charter during the session, which quantified the initiative’s benefits, timeline, cost, and risk. Metalworks is replicating this chartering work on the three remaining initiatives. Once these charters align with the executive team, these initiatives will be implemented using the company’s well-defined implementation tools.