Due diligence is an important part of any business acquisition. It helps to ensure that the deal you’re making is a sound decision, that you are relying on correct assumptions, and protects you from potential risks down the road. But performing adequate due diligence isn’t always easy. It requires the requisite effort, reasonable care, the knowledge of what information to look for and how to interpret it correctly, and of course, time. It is a painstaking process.

Having bought and integrated companies ourselves, we know the importance of good communication amongst all involved in the deal to minimize the disruption during the diligence period. We have seen firsthand how a disjointed diligence process can increase the risk level for your deal team and your organization.

If you’re looking to purchase a business or take on a new partner, this guide will walk you through the steps necessary for conducting effective due diligence to help ensure your decision is logic-based, not emotionally driven. At JACO, we encourage clients to avoid using a “cookie-cutter” approach. We believe you should customize the diligence process to fit the unique aspects of the deal being contemplated.

Types of Due Diligence

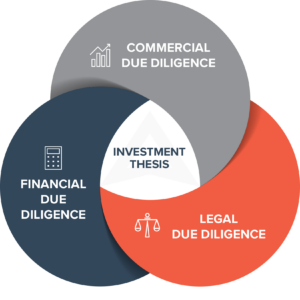

When we work with clients, we break the diligence process down into three broad categories: commercial, legal, and financial. Assessing the target company in these three areas allows you, as the acquiring firm, to assess the past, present, and future performance of the business. Using this approach will ultimately help you determine if the acquisition is worth pursuing.

- Commercial Due Diligence (CDD)

This part of the diligence process is an all-encompassing review of the business. This phase is very process-focused. It looks at how a company does business and who it does business with. It is both internally and externally focused, analyzing the past, present, and future performance of the target company.

- Financial Due Diligence (FDD)

This part of the diligence process focuses on the financial performance of the business. Examining the target company’s P&L, its balance sheet, and free cash flow helps ground your analysis with confident assumptions on the business’ future capacity for growth.

- Legal Due Diligence (LDD)

This part of the diligence process focuses on any legal and tax complications you need to be aware of. You can benefit from a deep understanding of the target’s past experiences and circumstances, as well as that of the broader industry, to account for future potential risks.

Who's responsible for synthesizing all the data?

JACO recommends identifying 1-2 people responsible for gathering all the data from the various members of the deal team (internal and external members) and synthesizing it into one master document. This enables all members of the deal team to understand the deal from different vantage points. It reduces duplication of efforts and the chance of something being overlooked. Finally, it allows the deal team to learn from each other and connect the dots much more efficiently.

How Long is the Due Diligence Period?

While the complexity of the deal often dictates the length of time needed, the due diligence process typically takes about 60 to 90 days. With our streamlined process, JACO likes to target having the diligence process completed in 30 to 60 days.

Diligence Checklist

Due diligence contains several elements, and leveraging our proprietary protocols, JACO uses an extensive diligence checklist to focus on:

- Defining the diligence requirements and scope of the investigation

- Gathering relevant documents and information

- Analyzing financial records

- Assessing legal compliance and risk exposure

- Evaluating management and the human element of the business, the business plan, and operations strategy

- Understanding the marketplace

- Reviewing customer contracts, agreements

- Investigating liabilities and hidden risks

- Performing background checks of key employees

- Understanding cultural alignment

- Ultimately creating a comprehensive report of findings

1. Define the scope of your due diligence

Before starting the diligence process, it’s important to have a clear understanding of the investment thesis for the deal. The investment thesis is a summary that outlines the assumptions of the acquiring company as to why they are doing this deal. This is an often-overlooked step, even by seasoned deal makers, on why they are making potential investments in a company.

Having a defined investment thesis will help define the scope of the due diligence to be performed.

Will it create shareholder value?

The thesis will be the standard by which you compare the findings from the due diligence investigations to assess risk, valuation multiples of similar benchmarked deals, and the purchase price of the target company. As part of the investment thesis don’t forget to test the thesis by performing a proforma shareholder value analysis. This analysis is a logic check by which you test your thesis and its reasonableness so that you will achieve your anticipated return.

Due diligence aims to identify any potential risks, issues, or red flags that could impact the value or success of the deal. By thoroughly examining all relevant information, you’ll be better positioned to make informed decisions and mitigate potential risks.

Additionally, we believe now is a good time to evaluate the downside risk. If your investment thesis is wrong, what is your downside exposure? As a general rule, understanding your exit options is prudent for a potential buyer to consider before investing.

Integration Plan

As you progress in the due diligence process don’t lose sight of developing an integration plan. While there is a lot of focus on getting a deal done, don’t overlook the importance of having a well-defined plan for what “Day 1” looks like once you own the business. Many good business transactions have failed to meet expectations because the integration plan was overlooked during the diligence process. As a best practice, we believe an integration plan should be developed in parallel with the due diligence process.

2. Gather relevant documents and information

The goal of diligence is to focus on both the seen and unseen aspects of the business. It is important to gather all relevant documents and information related to the scope of your diligence investigation. Some organizations like to use diligence software, while others use sophisticated spreadsheet checklists to evaluate business transactions, ensuring that no important task or topic is missed.

Whatever your preference, the key is to have a defined process by which you are going to evaluate the company you are looking to acquire.

We encourage our clients to dig deep – look at every aspect of the business including:

- Financial statements

- Contracts

- Licenses and permits

- Regulatory compliance

- Customer relationships

- Vendor relationships

- Human resources

- Supply chain resiliency

- Intellectual property

- Information technology policies and procedures

- Pending litigation

- EHS (environmental, health & safety) policies and records

- Financial transaction history and tax

The due diligence process can be a time-consuming and sometimes overwhelming task, which is why businesses of all sizes, private equity firms, family offices, and individual investors utilize professional advisors to manage the diligence process. Due diligence costs vary based on the size and complexity of the deal, but a good due diligence process is worth the investment, otherwise, you might end up taking on more risk than you had planned.

Having a complete understanding of the company you are acquiring can save you from financial or legal risk down the road. Identifying the key areas of investigation and determining what documents or information will be necessary to fully understand those areas from the beginning of the diligence period helps expedite the diligence process.

By taking a thorough approach to gathering information, you can feel confident in your due diligence and any subsequent decisions you make based on your findings.

3. Analyze financial statements and records

Analysis of Business Financials

Analyzing financial statements and records is a crucial task in any due diligence investigation. It allows you to understand the financial health of the company by examining its past and present financial performance. Examination of the balance sheets, income statement, and statement of cash flows will provide you with a starting point for your due diligence report.

By taking a closer look at audited and unaudited financial statements, you can identify trends, strengths, and weaknesses of the company, its financial position, and current practices between internal and audited financials. However, analyzing financial statements can be a complex process that requires expert knowledge and skills. And, if the company you are looking at has not been through a recent financial audit you need to investigate why.

We recommend that our clients seek the counsel of their Certified Public Accountant (CPA), legal counsel, and financial advisors, such as JACO Advisory Group, where appropriate.

Quality of Earnings (QoE)

A Quality of Earnings (QoE) analysis helps you understand how the company is reporting its financial performance and is an important piece of the due diligence process. It is a forensic accounting process used to uncover potential issues related to the quality of financial statements and records. This can involve identifying earnings manipulation, off-balance sheet activities, forced revenue recognition, tax evasion, and more.

That’s where professional advisors can come in handy. With their expertise, they can provide valuable insights into the true financial condition of the business you are looking to acquire.

4. Assess legal compliance and risk exposure

An important task in due diligence is assessing legal compliance and risk exposure. Any potential buyer should understand the current and long-term legal situation of the business, which can include:

- Assessing if the company is compliant with relevant laws and regulations

- Reviewing contract terms and obligations

- Conducting a thorough intellectual property audit

The goal is to identify any legal issues that could negatively impact the company and its ability to operate going forward. For example, if the business fails to comply with local, state, and federal laws, it could face significant liability or financial risks.

In addition to assessing existing legal risks, it’s important to consider any potential risks related to future operations including:

- A review of permits and licenses needed for operation

- A review of customer contracts

- An examination of any potential litigation or threatened legal action

5. Evaluate management, operations, and strategy

Due diligence also involves evaluating a company’s management, operations, and strategy. You can do this by:

- Reviewing the company’s staffing structure, organizational chart, and processes to ensure the company is running efficiently and effectively

- Evaluating the company’s current strategy and goals, as well as its competitive advantage in the market

- Interviewing key personnel, such as the CEO and CFO, to get a better understanding of their vision for the company and their commitment to its success

- Reviewing any potential agreements or partnerships with third-party vendors and suppliers to identify if the company’s ability to successfully execute its strategy will be affected

- Reviewing any potential liabilities or risks associated with the company’s current operations, such as environmental issues or employee disputes

6. Understand the marketplace for the business’s products or services

Due diligence should include an understanding of the market for the business’s products or services. This means taking a close look at the competitive landscape and assessing how the company stacks up against its competitors, and understanding what type of business relationship they have with their sales force. It also involves evaluating potential growth opportunities in the marketplace and any risks associated with them.

This type of due diligence can include:

- Researching current customer trends

- Identifying potential new markets

- Evaluating the company’s pricing strategy

- Understanding the overall industry landscape, including any regulatory or technological changes that could affect the business in the future

7. Review customer relationships, contracts, and agreements

It’s important to understand the type of relationships the business has with its customers, as well as any loyalty programs or other incentives that may be in place. Therefore, another key part of due diligence is to review customer relationships, contracts, and agreements, which could mean taking a close look at any existing customer contracts to understand the terms and conditions of each agreement and the legal obligation each contract has to the company. It also involves researching any potential customers who have recently expressed interest in the company’s products or services.

Additionally, you’ll need to review any potential conflicts of interest between the company and its customers. By taking an in-depth look at customer relationships, contracts, and agreements, you’ll be able to better understand the company’s ability to generate new business and maintain its existing customer base. This will help you better assess the company’s overall potential for growth in the future.

8. Investigate potential liabilities or hidden risks

Due diligence also involves investigating potential liabilities or hidden risks associated with the business. This includes exploring any legal issues related to the company, such as potential lawsuits or regulatory violations. It also involves assessing the company’s ability to protect its intellectual property, such as patents and trademarks, and reviewing any potential risks related to the company’s partnerships and investments.

Additionally, it’s important to understand the company’s environmental practices to ensure compliance with applicable laws and regulations.

9. Perform background checks on key individuals involved in the transaction

To help potential buyers make an informed decision about their investment, it’s important to perform background checks on key individuals involved in the transaction to help you better assess their credibility and trustworthiness.

This includes reviewing their educational and professional credentials, as well as any previous business experience they may have. Additionally, you should investigate any potential conflicts of interest between these individuals and the company they are representing.

10. #1 Deal Killer – Cultural Alignment

A final important component of due diligence is cultural alignment. This involves assessing how well the company’s values and mission align with those of potential buyers. It’s important to understand the company’s stated core values and beliefs, as well as how it actually goes about conducting business.

By understanding cultural alignment, potential buyers can ensure that any investment they make is in line with their values and mission. This will help to ensure a successful long-term partnership.

11. Create a comprehensive report to present the findings

After completing the due diligence process, it’s important to create a comprehensive report that summarizes all the findings. This report should include:

- All the financial, legal, operational, and marketplace information uncovered during the due diligence process

- An analysis of the potential risks and liabilities associated with the company

- Recommendations for further action based on the findings during the due diligence process.

Deal Killers & Deal Shapers

Due diligence is an important process that provides potential buyers with the information they need to make an informed and educated decision about a business acquisition. It’s important to remember that every business you look at will have issues. Once these issues are found, it’s the deal team’s responsibility to determine whether they are “deal killers” or “deal shapers”. Deal killers have obvious ramifications, while deal shapers can be remedied contractually, structurally, commercially, or in other ways. Creative solutions can minimize risk for all parties.

Qualified advisors can help you assess risk, and identify any potential liabilities associated with a business transaction. They can also provide guidance and advice on how to proceed with a due diligence process. It’s important to seek the advice of your advisors when considering any business acquisition because they will be able to provide you with the best advice and guidance on how to take your due diligence process forward.

If you are a business owner and would like to talk about how we help companies through the diligence process, give us a call, or drop us an email, we would welcome the opportunity to learn more about your business and what you are looking to do with a potential business transaction.

About Tim

Tim is a proven leader with over 30 years of Marketing and Sales experience within the consumer products and goods industry. He has experience in growing leading brands like Chiquita, Borden, Scotts, Miracle-Gro and Roundup. His extensive leadership experience spans across General Management and P&L ownership, Marketing and Sales, New Product Development, Consumer Research and Insight, Strategic Planning and M&A.

Currently he is serving as Chair of Marburn Academy’s Board of Trustees, a school that serves children who learn differently due to executive function, ADHD, and dyslexia learning challenges.

Tim holds a BS Degree in Business from Miami University in Ohio and an MBA from Clark University in Massachusetts.