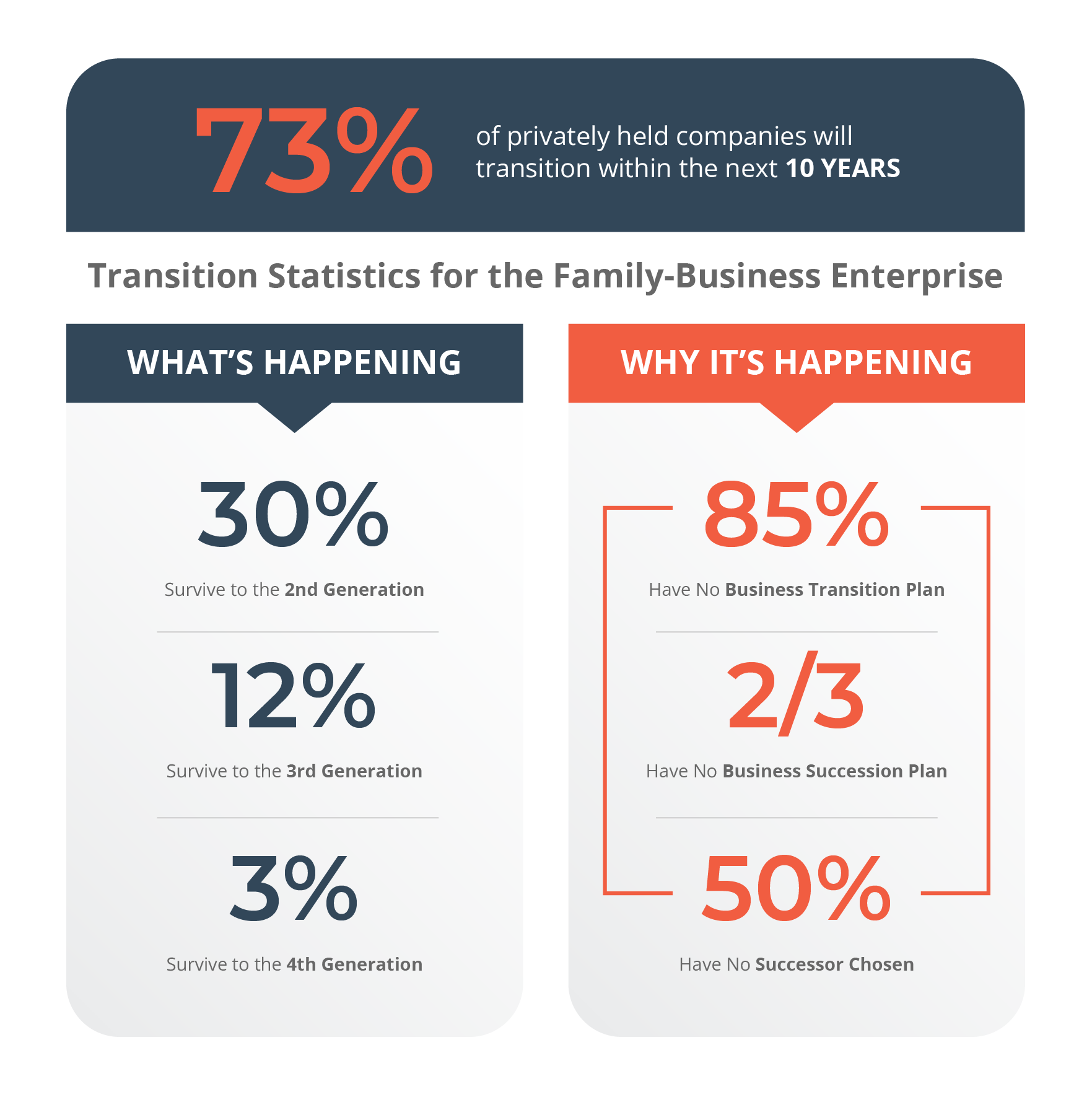

Every business needs a succession plan. We help you create one that focuses on the transition before the transaction, ensuring your business remains viable and your family relationships stay intact. Whether your priorities are family legacy, employee security, financial returns, or your future role in the company, JACO Advisory Group helps family-owned, closely-held, middle-market businesses navigate succession based on what actually makes them successful—business viability, leadership development, and family dynamics.

Not sure where to start? We can help.

We help you organize your thoughts, define your objectives, and translate them into an actionable succession plan that delivers your intended timing and outcomes. Because succession planning is a team activity, we coordinate across your internal and external advisors to ensure alignment—resulting in a cohesive strategy rather than fragmented or conflicting advice.